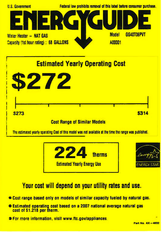

A home is the biggest appliance we'll ever own, yet we have no idea what it will cost us until after we sign a 30-year mortgage. A lot of folks pay attention to the yellow label on appliances before they buy, but don't yet have the option to house-hunt by the energy signature of an older home. A home comes with no owner's manual or energy rating, yet even a toaster has those. Most folks simply accept that the monthly energy bill is a given, not realizing they can reduce it with efficiency and conservation, as well as behavior changes.

If we knew the energy factor for our home and how it compared to our neighbors, we might be more incentivized to implement all the recommendations of a thorough energy audit. The DOE’s Home Star program is a great idea for providing energy ratings for homes and should be implemented.

If we knew the energy factor for our home and how it compared to our neighbors, we might be more incentivized to implement all the recommendations of a thorough energy audit. The DOE’s Home Star program is a great idea for providing energy ratings for homes and should be implemented.

Educating clients and Realtor's is part of the solution. Nurturing an environment for promoting home ratings without mandating such is equally important. If homeowners and Realtor's demand ratings and efficiency, builders will be all over it, educate themselves, rise to the occasion, or be out of business. Considering a home is typically the biggest part of our domestic energy budget, we should be rating all homes that come on the market.

Few banks have yet to recognize the role rising fuel prices played in this last housing collapse and recession, or even previous ones. Economists have shown that owners of efficient homes with low energy bills are less likely to default on their mortgage. Banks that provide loans based on efficiency might give a better interest rate for a net Zero Energy home and a higher rate for an energy hog home, unless an energy efficiency plan were part of the mortgage plan.

We make our best decisions when we know all the facts, and until we know the energy rating of our homes, we may not be making the right decision when purchasing one, yet we don’t know it.

Dale Sherman

President

Few banks have yet to recognize the role rising fuel prices played in this last housing collapse and recession, or even previous ones. Economists have shown that owners of efficient homes with low energy bills are less likely to default on their mortgage. Banks that provide loans based on efficiency might give a better interest rate for a net Zero Energy home and a higher rate for an energy hog home, unless an energy efficiency plan were part of the mortgage plan.

We make our best decisions when we know all the facts, and until we know the energy rating of our homes, we may not be making the right decision when purchasing one, yet we don’t know it.

Dale Sherman

President

RSS Feed

RSS Feed